Historic Tax Credits, Project Profile: Gretna's Amoco Service Station

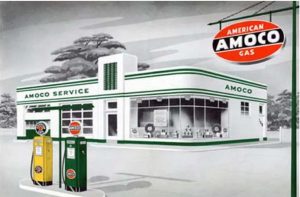

The 1940 Amoco Service Station in Pittsylvania County’s Town of Gretna was built in the tradition of “ice-box” gas station architecture and according to corporate specifications. The stuccoed, concrete-block building possesses a quasi-rectangular form adorned with delightful mid-20th century details, although it is distinct from many existing Amoco stations from that era.

Amoco stations of the period conformed largely to the classic corporate design that Amoco architect George Terp promulgated after World War II for new and remodeled service stations. The Gretna Amoco, however, was one of a few such stations not remodeled later along Terp’s classic design. For instance, Gretna’s station retains its original corner entrance, a survivor from a slightly earlier design era. The original building also featured a distinctive vertical entry tower, a semi-circular entrance canopy, and an arresting paint scheme. The streamlined design sought to snag the eyes of potential customers and, today, the building is the only example of Art Deco architecture in the Gretna Commercial Historic District. The structure’s interior historically possessed both a retail section, defined by large, plate-glass windows, and vehicular service lanes.

In the 1970s, the building was converted for use as a hair salon that occupied the service bays. At that time, the garage openings were enclosed with modern storefronts, the concrete block interior walls clad with wood paneling, and the distinctive exterior paint scheme covered over. However, Gretna locals still remembered the building’s lively original appearance.

In 2020, the building’s newest owner, a financial advisor, converted the former service station for use as her office using historic tax credits (HTCs). While not a requirement of the HTC program, in this case, the owner decided to return the station to its 1940s era appearance. The result is striking. The distinctive, original paint scheme was reestablished based on evidence in the stucco. Fixed garage doors replaced the modern storefronts that had enclosed the historic service lanes. The building’s original windows were restored, and two windows that were thought to have been removed were rediscovered under layers of modern brickwork. Work to the interior exposed the painted, concrete-block walls and the concrete floor in the service bay that housed the hair salon.

Minor floorplan changes helped accommodate the new office use. The original plan, for example, included two tiny, separate bathrooms for men and women, with the women’s lavatory accessed from an exterior door. Working within the requirements of the HTC program, the rehabilitation combined the two bathrooms into a single, ADA-compliant restroom, with the interior doorway slightly widened to meet code requirements. The owner also subdivided one of the service bays to accommodate a lounge and office.

The Gretna Amoco Service Station’s successful rehabilitation has restored a unique piece of automobile history to its original charm. The building has regained its old appearance, while attaining new life as an office. Historic tax credits have been successfully used in the adaptive reuse of a number of historic Virginia gas stations, including the Edgehill Service Station in Gloucester, Carlin’s Amoco Station in Roanoke, Speers Gas Station in Ashland, and the Texaco Building in Norfolk, among others. These projects are proof of the tax credit’s versatile application to a wide variety of building types, from service stations to residential dwellings to large industrial complexes.

–Carolyn Zemanian

Architectural Historian, Tax Credit Reviewer

Preservation Incentives Division, DHR

(Photographs courtesy of property owner)